Interest rate expectations

7th October 2022

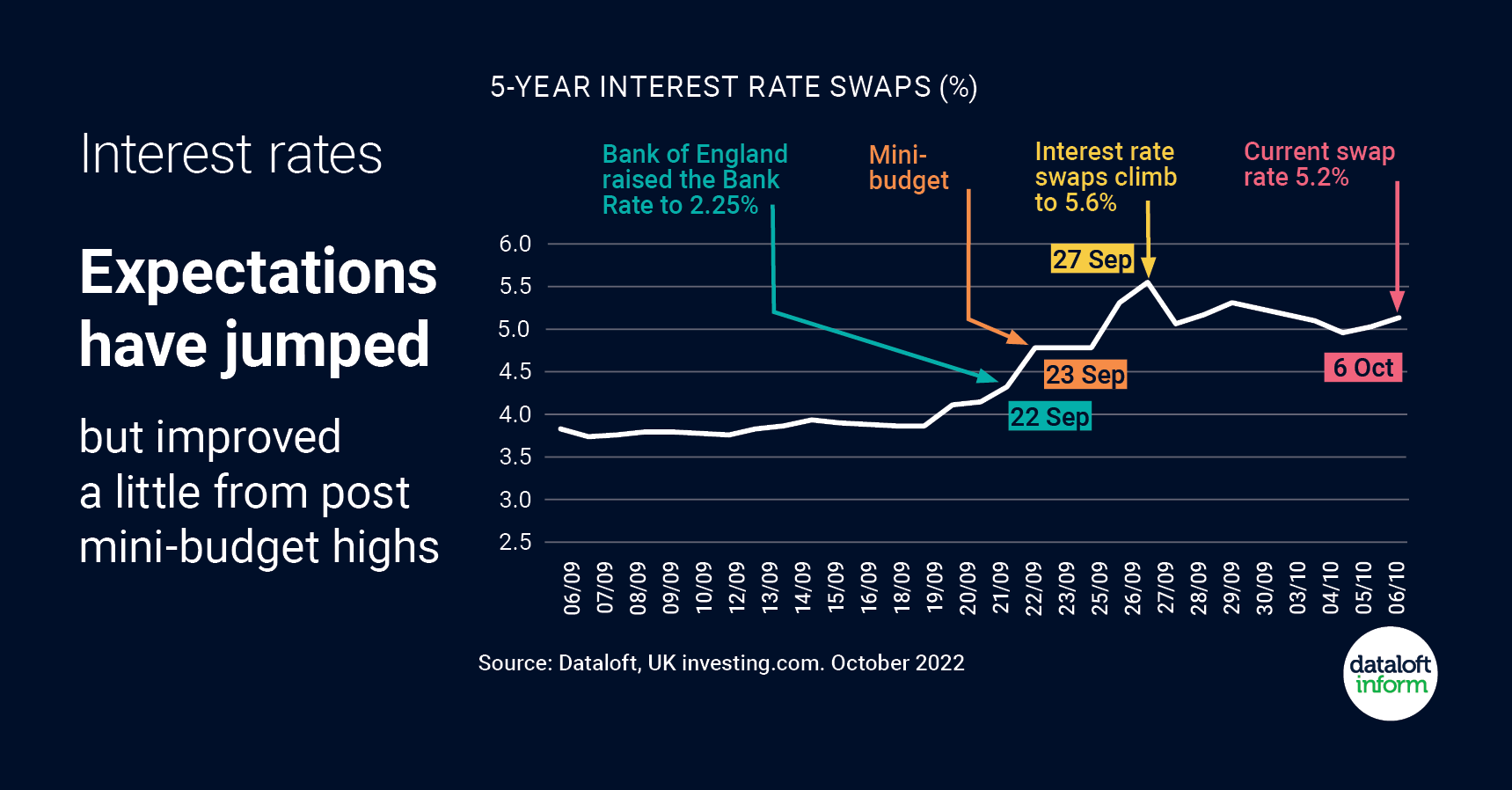

As widely reported, the Chancellor’s mini-budget spooked markets and resulted in the value of the pound sliding and interest rate expectations jumping up.

Swap rates are often used as an early warning of where mortgage interest rates are heading. Immediately after the mini-budget, 5-year swap rates climbed to a high of 5.6% but have since improved a little to 5.2%.

The next few weeks leading up to the Bank of England’s next meeting and the Chancellor’s budget are likely to be volatile for interest rate expectations.

Interest rates are definitely rising but with current volatility the extent they will need to rise is still unclear.

Source: Dataloft, UK investing.com

Autumn Budget 2025 – Key Property Points

31st October 2024

As the UK grapples with a severe housing shortage, will new tax policies and a £5 billion spend pledge be…

Employee of the Month – October 2024

16th October 2024

Our employee of the month for October is our Head of Finance – Kayleigh Beal! Kayleigh works extremely hard, with…

House Prices and Consumer Confidence

11th October 2024

Despite the September fall in consumer confidence, levels remain well above the lows of 2022. This recent faltering is likely…