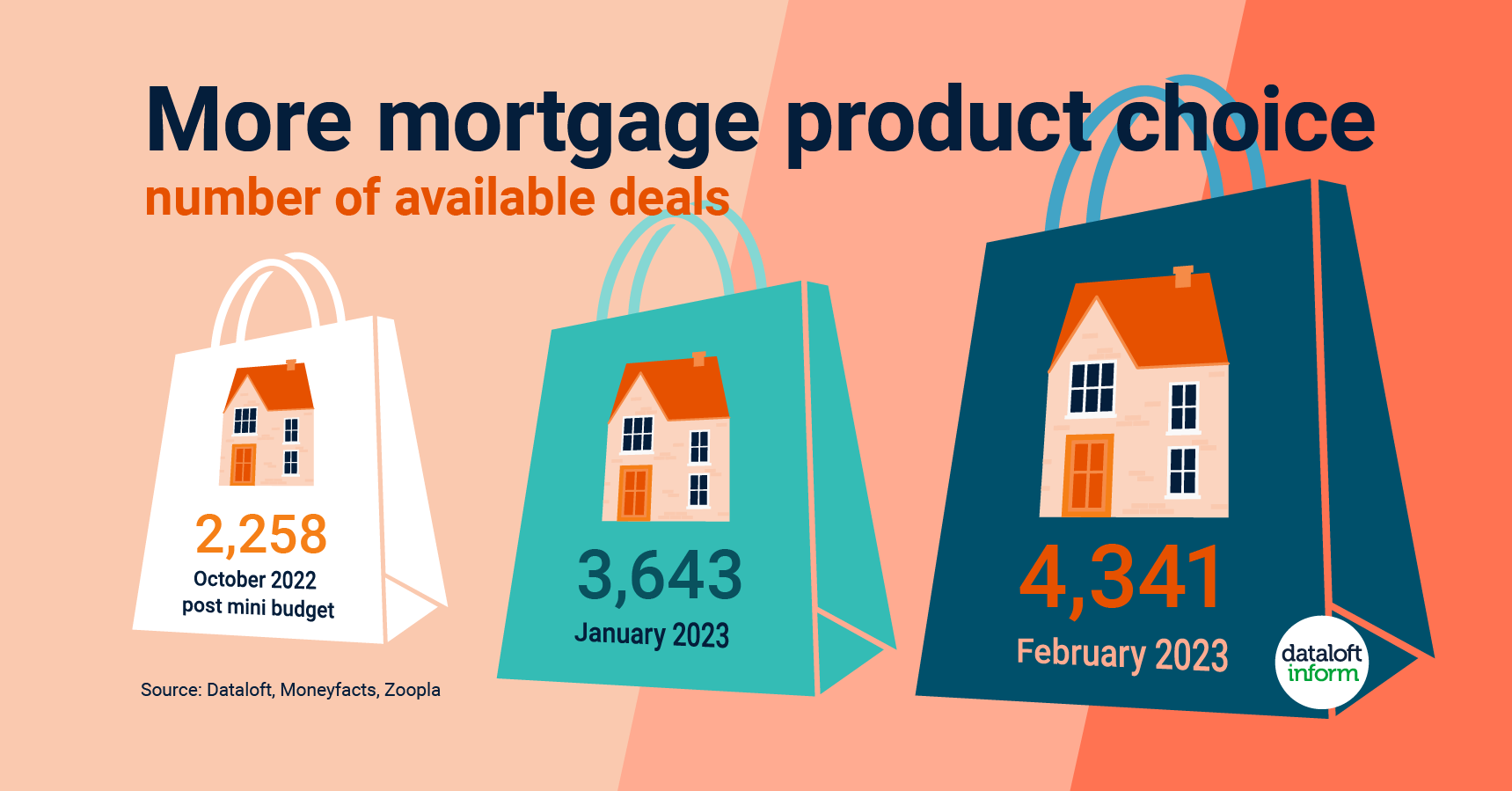

More mortgage product choice

6th March 2023

Across the mortgage market product choice is increasing. According to Moneyfacts there are more than 4,300 different deals available. This is the first time since August 2022 that product choice has risen above 4,000.

Competition between lenders in the mortgage market is good news for prospective buyers and home movers. The average interest rate charged on both two-year (5.44%) and five-year deals (5.2%) fell in February for the third month in succession.

The latest falls put the cost of both products back to October 2022. This is despite the fact that the Bank of England has since raised the base rate of interest by 1.75%.Product availability has risen across all deposit levels, with close to 150 deals available for those with a 5% deposit, and nearly 540 for those with a 10% deposit. For those requiring a loan-to-value of 60% or less, deals with rates below 5% are now available. Source: Dataloft, Moneyfacts, Zoopla

Autumn Budget 2025 – Key Property Points

31st October 2024

As the UK grapples with a severe housing shortage, will new tax policies and a £5 billion spend pledge be…

Employee of the Month – October 2024

16th October 2024

Our employee of the month for October is our Head of Finance – Kayleigh Beal! Kayleigh works extremely hard, with…

House Prices and Consumer Confidence

11th October 2024

Despite the September fall in consumer confidence, levels remain well above the lows of 2022. This recent faltering is likely…