Clear relationship between mortgage approvals and sales volumes

3rd April 2023

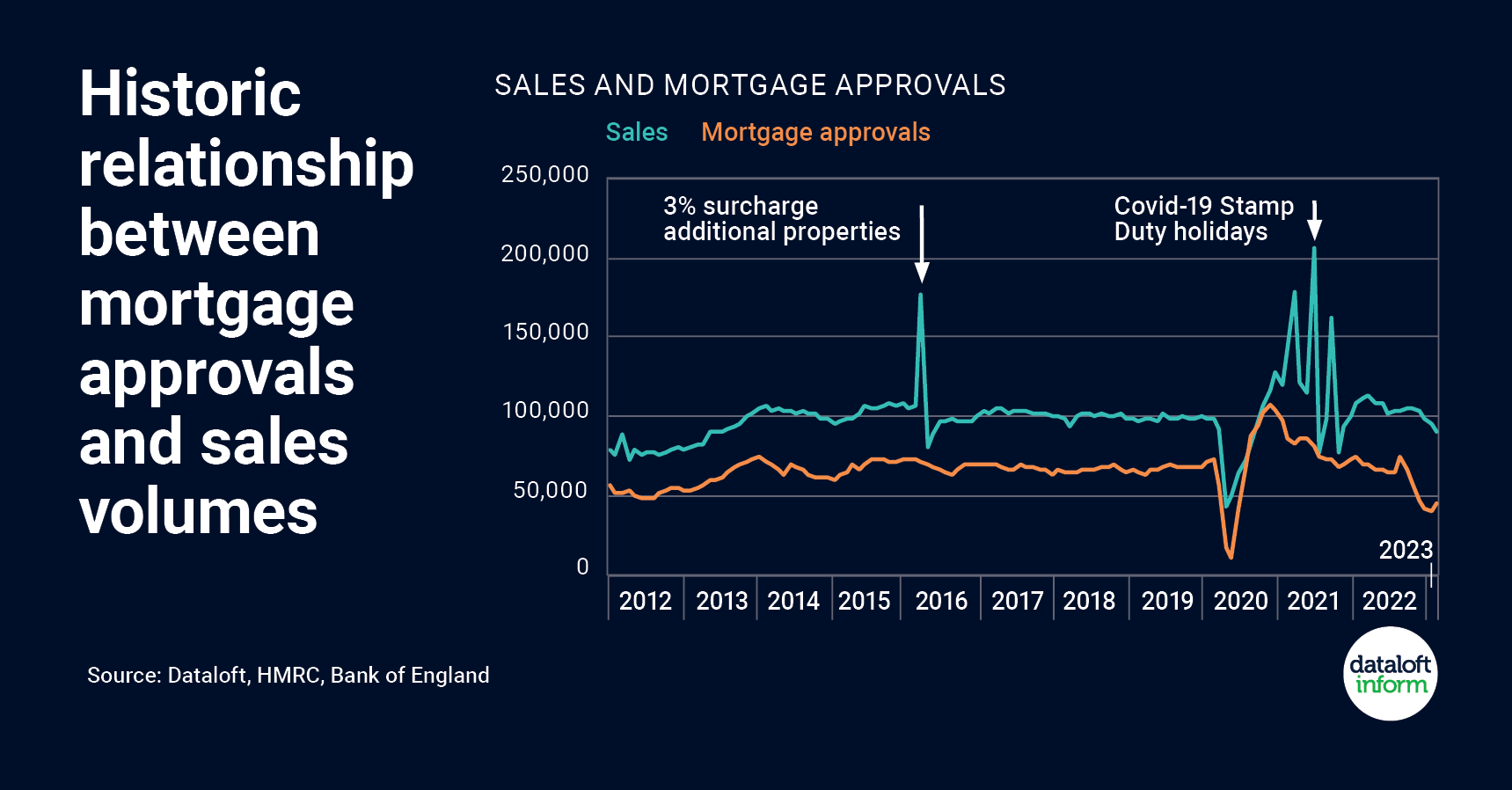

Official data indicates sales volumes in February were 4% lower than January, while mortgage approvals for the month were 10% higher, the most significant uptick at this time of year since 2011.

In the 5 years prior to the pandemic, mortgage approvals in February were on average 1.2% lower than in January. With mortgage approvals considered a forerunner of housing market activity, demand in the sales market is likely to rise over the spring.

The mortgage market is stablising. The decision by the Bank of England to raise the base rate of interest to 4.25% was largely expected and there has been little movement in long-term swap rates since the announcement.

Spikes in sales volumes in recent times have historically been linked to government changes to property taxation. The impact of changes in 2016 and 2021 is clearly visible.

In the last decade peaks in the sales market have been associated with changes to property taxation including the 3% surcharge on additional homes in 2016 and the Stamp Duty Holiday in 2021. Source: Dataloft, HMRC, Bank of England

Autumn Budget 2025 – Key Property Points

31st October 2024

As the UK grapples with a severe housing shortage, will new tax policies and a £5 billion spend pledge be…

Employee of the Month – October 2024

16th October 2024

Our employee of the month for October is our Head of Finance – Kayleigh Beal! Kayleigh works extremely hard, with…

House Prices and Consumer Confidence

11th October 2024

Despite the September fall in consumer confidence, levels remain well above the lows of 2022. This recent faltering is likely…