Investing in HMOs

25th September 2023

Letting your property as an HMO (House in Multiple Occupancy) is a viable alternative to more traditional buy-to-let properties. Generally more profitable, HMOs provide multiple streams of income by letting out individual rooms at a higher rate than you would the entire property. This can also reduce the impact of void periods.

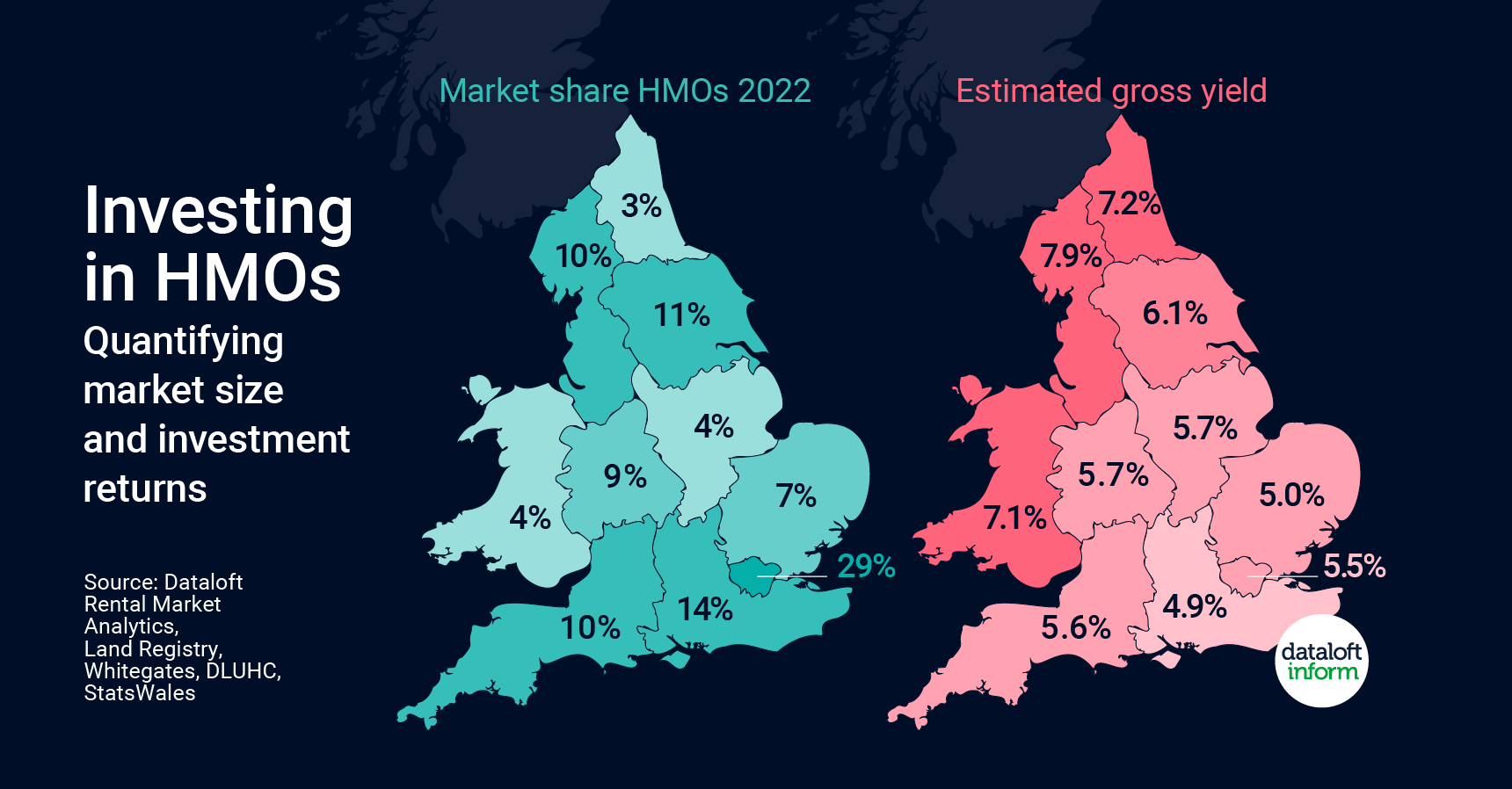

Average gross estimated yields of up to 7.9% are achievable in the North West, where student populations are high and demand for more afforable housing is strong.

Of the estimated half a million HMOs in England and Wales, by far the most (29%) are found in London. The scarcity principle applies, and places with the lowest number of HMOs such as Wales (4%) have strong average yields of 7.1%.

This clear demand for HMOs, coupled with attractive yields, provides a convincing argument for considering this method of letting.

Source: #Dataloft Rental Market Analytics, Land Registry, Whitegates, DLUHC, StatsWales

Budget Summary at a Glance

26th November 2025

A chaotic start with early publication from the OBR, but here’s what actually matters from today’s fiscal plan: Budget Summary…

Budget Chaos and What It Means for Brighton & Hove Landlords

26th November 2025

Well that was interesting! Today’s Budget took an unexpected twist when the details were released in full and online by…

Renter’s Rights Bill receives Royal Assent: What landlords need to know

28th October 2025

RRB has since received Royal Assent after this article was published. Just over a year since it was first brought…