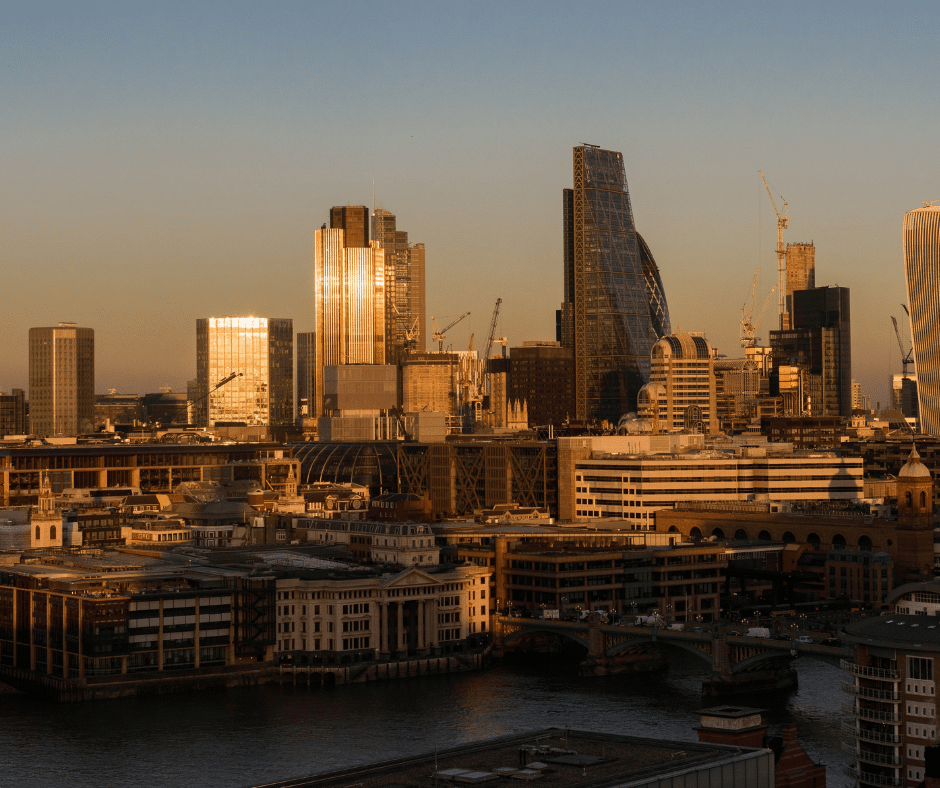

England’s Housing Crisis: Among the Worst in the Developed World?

9th October 2023

A recent analysis has revealed that England is grappling with one of the most severe housing crises among developed nations. This report comes from the Home Builders Federation (HBF), representing developers in England and Wales, which examined data from the OECD, the EU, and the UK government.

Key findings of the analysis include:

- Severe Shortage of Housing: England is facing a dire shortage of homes, making it the most challenging place among OECD nations to find a residence. The availability of properties per capita in England is the lowest among all OECD countries.

- High Proportion of Inadequate Housing: England also boasts the highest percentage of substandard housing in Europe, with 15% of existing homes failing to meet the Decent Homes Standard. This is a higher proportion than countries like Hungary, Poland, and Lithuania.

- Age of Housing Stock: The UK has some of the oldest housing stock in the developed world, with only 7% of British homes built after 2001, compared to countries like Spain (18.5%) and Portugal (16%).

This housing crisis has far-reaching consequences, including the increasing unaffordability of homes for many residents. Between 2004 and 2021, home ownership in the UK fell by six percentage points, from 71% to 65%. In contrast, France and the Netherlands experienced growth in homeownership during the same period.

Despite political promises to boost housing numbers, the UK has struggled to meet its target of constructing 300,000 new homes annually by the mid-2020s. In 2021-22, only 233,000 new homes were completed, and delivery in the first half of 2023 dropped by 10%.

To reach the benchmark for developed nations set by the OECD, which necessitates 320,000 new homes annually, England would need a significant increase in housing construction. Even to match the housing levels per thousand inhabitants of smaller European nations like Belgium and Denmark, England would need to build 291,000 and 390,000 new homes per year, respectively, until 2030.

The analysis also highlights the staggering unaffordability of homes in England and Wales, where the average property price is over eight times the average salary. Even when compared to countries with reputations for expensive housing, like Denmark, the UK fares poorly, with a 37% increase in the house price-to-income ratio between 2004 and 2021.

In addition to affordability issues, the UK lags behind Eastern European nations in terms of the modernity and condition of its housing stock. Countries with smaller economies, such as Hungary, have a higher proportion of modern homes.

Overall, this analysis paints a stark picture of England’s housing crisis, emphasising the urgent need for substantial reforms and increased construction to provide affordable, quality housing for its residents.

The Renters’ Rights Bill – Where are we now?

20th March 2025

The Renters’ Rights Bill continues its progress through the House of Commons and is now at the Committee stage in…

Beginning of the end for Leaseholds in the UK

20th March 2025

The Ministry of Housing, Communities and Local Government announced at the beginning of March that they are now making serious…

Employee of the Month- February 2025

6th March 2025

Here at Coapt we are happy to announce our February employee of the month- Florence! Florence is our Lettings Coordinator…