Brighton market insights

7th May 2019

Why buyers love Brighton so much, and why it matters to you

There are few things in life that you can trust more to enrich your family than the property they live in. While this is true in terms of the memories it creates and the special moments it hosts, it’s also true in terms of cold, hard material gain.

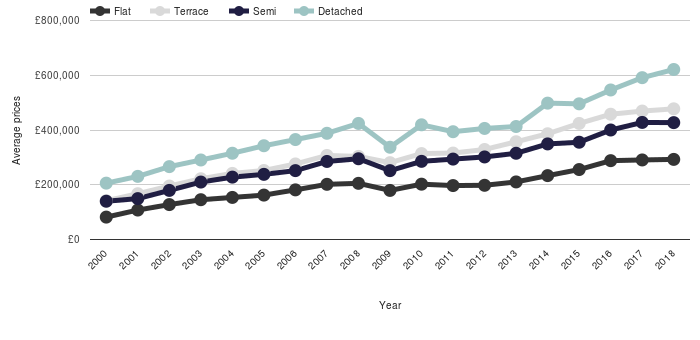

Since 2000, the average Brighton home has increased in price by 245.4 per cent. The best performing property type has been flats which have increased by 255.8 per cent, equivalent to £12,300 per year. The reason this particular type of home has outperformed the rest is down to a number of factors, but in essence it’s simply down to this being the home of choice for Brighton residents.

For anyone who has ever spent much time here, the attractions are fairly obvious. A great balance of first-rate housing stock, solid transport accessibility and ready access to the amenities we need the most. It is these factors which explain why our area has outperformed the national market during this period of cooling which has been felt in many parts of the country.

The popularity of Brighton as a place to live is unlikely to diminish any time soon. If you’re considering buying or selling in this area, now is the ideal time. There are great opportunities for buyers and sellers in every corner of the market. As long as you work with a local market expert, you’re destined to win big.

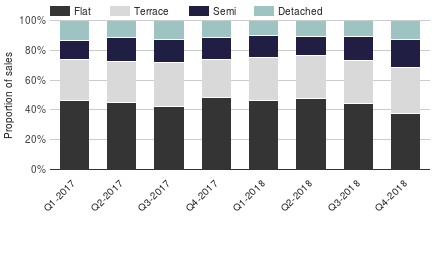

The proportion of sales by house type

For this month’s market update, we’ve decided to take a look at what percentage of total sales each house type accounts for each quarter. Whilst it doesn’t show the actual number of sales, it’s very useful for seeing what each property type is contributing to the total level of transactions.

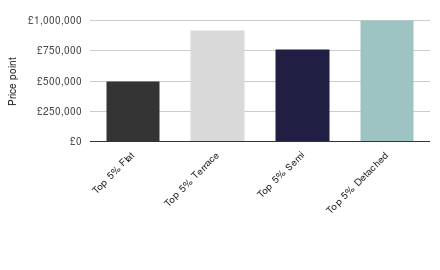

Top 5% of properties in the local area

We were interested in looking at the selling prices of the top 5% of properties in the local market. This chart displays the main house types side-by-side so you can see how they sit relative to one another.

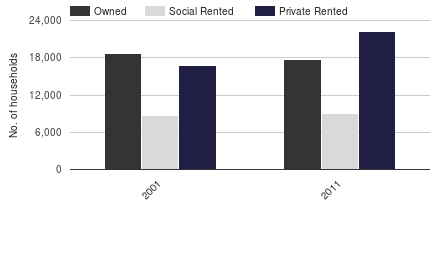

Local tenure patterns

The tenure mix of properties really defines what makes the local market tick. This chart shows how many people own, rent privately and rent from the council or a housing association. It’s very interesting to see how this changed between the last two censuses. In most, but not all of the country, private renting has increased substantially.

Employee of the Month- March 2025

7th April 2025

Huge congratulations to Adam, our incredible Sales Manager, for being named Employee of the Month! From starting as a one-man…

The Renters’ Rights Bill – Where are we now?

20th March 2025

The Renters’ Rights Bill continues its progress through the House of Commons and is now at the Committee stage in…

Beginning of the end for Leaseholds in the UK

20th March 2025

The Ministry of Housing, Communities and Local Government announced at the beginning of March that they are now making serious…