House Prices and Consumer Confidence

11th October 2024

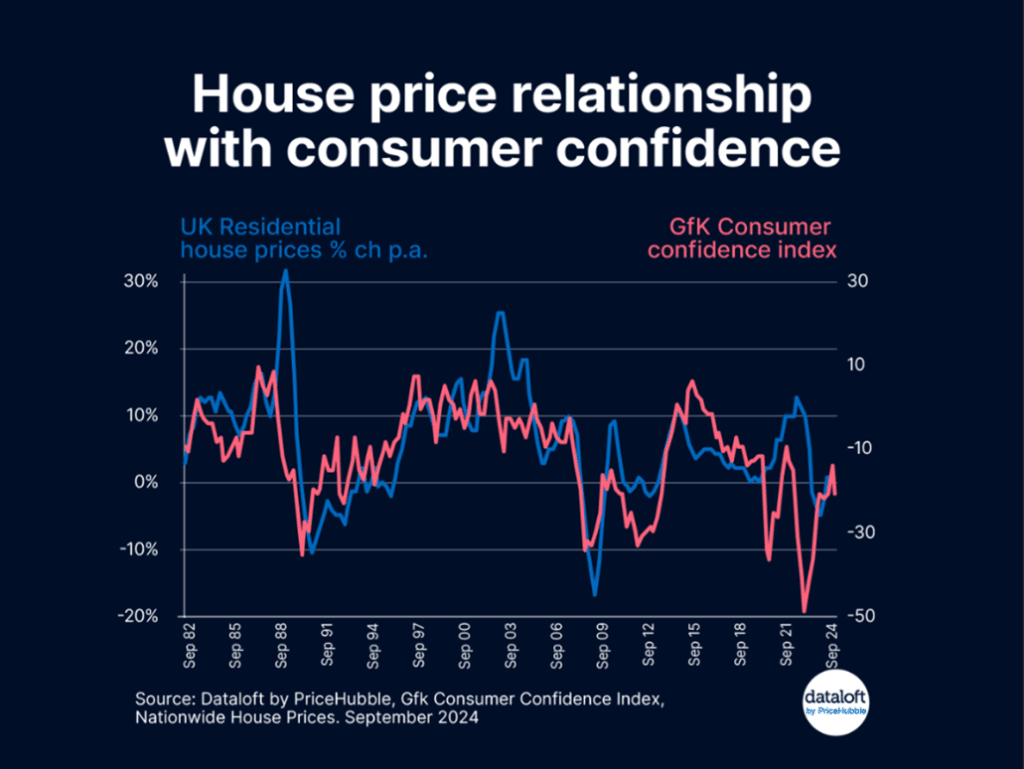

- Despite the September fall in consumer confidence, levels remain well above the lows of 2022. This recent faltering is likely short-term, due to concerns over the Budget.

- There is a strong historic relationship between consumer confidence and house prices.The fall in confidence might well limit the interest rate boost to prices over the next month or two and sellers should remain realistic on pricing.

- However, the government’s commitment to economic growth and its belief in the housing market as an engine of growth, is reassuring. House prices have often proved more resilient than consumer confidence trends might suggest.

Source: Dataloft by PriceHubble, GfK, Nationwide House Prices

The Renters’ Rights Bill – Where are we now?

20th March 2025

The Renters’ Rights Bill continues its progress through the House of Commons and is now at the Committee stage in…

Beginning of the end for Leaseholds in the UK

20th March 2025

The Ministry of Housing, Communities and Local Government announced at the beginning of March that they are now making serious…

Employee of the Month- February 2025

6th March 2025

Here at Coapt we are happy to announce our February employee of the month- Florence! Florence is our Lettings Coordinator…