Interest rates go up… and down…

7th November 2022

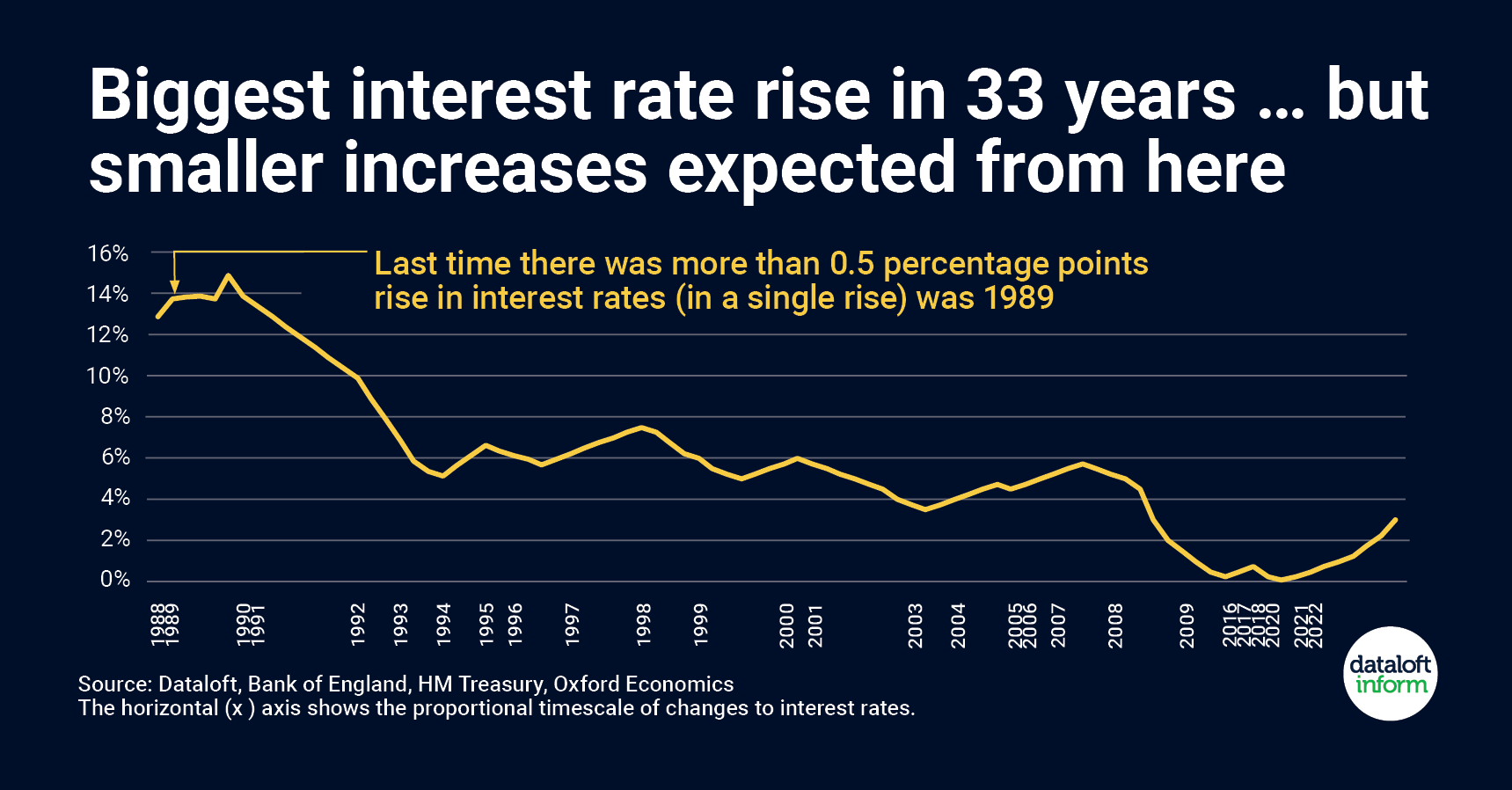

On Thursday 3rd November 2022, the Monetary Policy Committee voted to raise interest rates by a further 0.75 percentage points to take interest rates in the UK to 3%. This is the biggest increase in 33 years to try and curb inflation.

Only last month, the prediction was that UK interest rates would rise by 1 percentage point in November, so the increase is smaller than the housing market was previously expecting as sentiment has calmed after the change of Chancellor and Prime Minister.

The HM Treasury Consensus Forecasts for 2023 anticipate inflation averaging 4.1% as a central scenario. Making a big change now should help limit the size of any further interest rate increases.

Oxford Economics expects interest rates to continue to rise gradually from here and peak at 4% in 2024 before falling by a percentage point each year thereafter to 1.75% by 2027.

Source: Dataloft, Bank of England, HM Treasury, Oxford Economics

Budget Summary at a Glance

26th November 2025

A chaotic start with early publication from the OBR, but here’s what actually matters from today’s fiscal plan: Budget Summary…

Budget Chaos and What It Means for Brighton & Hove Landlords

26th November 2025

Well that was interesting! Today’s Budget took an unexpected twist when the details were released in full and online by…

Renter’s Rights Bill receives Royal Assent: What landlords need to know

28th October 2025

RRB has since received Royal Assent after this article was published. Just over a year since it was first brought…