Is 2023 the year to expand your property portfolio?

22nd February 2023

Buy-to-let (BTL) investments can provide excellent returns for investors who are seeking longevity in the market. However, as with all investments, it comes with its own unique risks and challenges that are determined by uncertain economic climates. According to HMRC, BTL transactions decreased by 18% in the fourth quarter compared to the same period in 2021 and by a whopping 31% from the third quarter of 2022. At present, between rising mortgage rates, less generous tax treatment, and tightening regulations, for many landlords, it’s difficult to ascertain whether increasing your property portfolio is strategic at this time. With over half of landlords planning to engage with the market by either selling or buying property this year, it’s crucial that our network is well-informed of both the negatives and positives of investing at this time. We want to share three reasons why it could be a great time to expand your existing portfolio, so you can make well-educated decisions going forward.

1.There is a significant shortage of rental stock.

The surge in demand for rental properties is becoming ever more apparent, both in the private rented and student accommodation sector. This competition for new lets has led to a rise in monthly rentals, with the ONS reporting a 4.2% rise in December 2022. Despite rises in the costs associated with being a Landlord, rise in rental figures mean that cash flow focused investors can rest easy; balancing the books should remain achievable and in fact profitable. Whilst gross rental figures have been on the rise since the end of the pandemic, this did not translate into better yields, due to the equally rapid growth in purchase prices. With asset values now levelled off, and lowering in some regions, as rents keep growing, yields become better.

2. Shifting to a buyers market

Generally speaking there is now more angst among property Vendor’s than for most of 2022. This can be attributed to many reasons, such as the seller’s variable rate mortgage increase, their need to access equity that is tied up in their home, or even their desire to downsize, there will always be motivated sellers despite market fluctuations. This means its becoming easier to negotiate good purchase prices on quality assets. This only adds to the longer term benefits of property investment, and capital gain focused investment strategies.

3. You can get ahead of upcoming legislation

With the government publishing its long-awaited white paper ‘A Fairer Private Rented Sector’ last June, the enclosed proposals have caused speculation and widespread opinions amongst the landlord community. The recent Levelling Up, Housing and Communities (LUHC) Committee publication has provided some clarity to this matter, but it is safe to say that there will be upcoming changes in legislation, even if the specifics are still being debated. Knowing this can provide an opportunity to buy an investment property now that is already compliant, or give you leeway to carry out any necessary works before you bring the property to market. Keeping a mind to the future allows for the ability to mitigate or stay ahead of future costs. As a direct and obvious example, if a further proposed increase to minimum BTL EPC standards comes into place, properties already meeting the new standards would be expected to increase in value, compared to similar stock that is not yet up to scratch. Looking out for such rated property now, will mean shrewd long-term benefits.

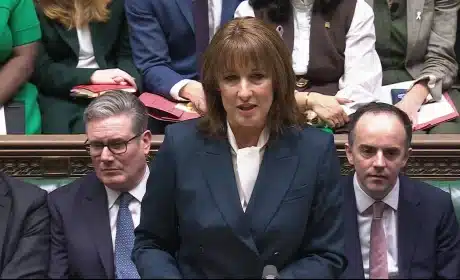

Budget Summary at a Glance

26th November 2025

A chaotic start with early publication from the OBR, but here’s what actually matters from today’s fiscal plan: Budget Summary…

Budget Chaos and What It Means for Brighton & Hove Landlords

26th November 2025

Well that was interesting! Today’s Budget took an unexpected twist when the details were released in full and online by…

Renter’s Rights Bill receives Royal Assent: What landlords need to know

28th October 2025

RRB has since received Royal Assent after this article was published. Just over a year since it was first brought…