Guidance from GLM Ghest Lloyd accountants

29th June 2017

Our Accountants GLM Ghest Lloyd work with many landlords and are extremely experienced in property taxation. We will be publishing exclusive articles written for MTM to cover topical issues concerning landlords.

The first article concerns the removal of the wear and tear allowance and the reduction in the amount of interest relief available to landlords who have funded the purchase of property with a mortgage.

The subjects to be covered over the next few months will be:

Making Tax Digital

What is the best way of holding new property interests?

Is it worth considering incorporation of an existing property business?

Inheritance tax matters to be considered

The main problem with articles like this is that they can only give general information. Each person has their own set of circumstances and it is only by looking at these and taking all things into account that an appropriate financial strategy can be established for a client.

glm Ghest Lloyd are based near Croydon and their senior partner Charles Marsh would be happy to discuss any of the issues above.

Their contact details are:

Telephone: 0208 668 0500

Email: charles@ghestlloyd.com

Legislation has hit the letting sector hard. There are many changes some of which may affect you.

Wear and Tear Allowance

Do you furnish your property and have you claimed Wear and Tear allowance in the past?

Did you know that from 6th April 2016 you will only be able to claim the domestic items relief? This will affect the tax return you prepare for last year 2016/17 and future years.

Reduction in Finance charges relief

Do you personally own property and pay interest on borrowings that you claim against your property income?

From 5th April 2017 the cost of funding property purchase relief against rental profits is being phased out and being replaced by a relief at 20%. The new rules are being introduced over four years. In 2017/18 one quarter of the interest falls into this category and then each year thereafter a further quarter until in 2020/21 the full rigours of this measure will bite.

The amounts that are subject to this restriction include interest, mortgage valuation fees, and application or arrangement fees, in fact any costs associated with the raising of a mortgage and putting it in place.

If you are not a higher rate taxpayer you might think that this is not going to concern you but you may be mistaken. The effect of the new rules is to increase the rental profit by disallowing the deduction for finance costs. This measure effectively increases your rental income by the finance costs and could well put you into the higher rates of tax even though you may not be today.

The income pushed into the higher rates of tax effectively bear an additional 20% tax over the current position. Or will fully do when the measures finally bite.

It is possible that a property that is currently contributing positive cash flow may turn into a negative cash flow. This will only happen where the cost of funding is a high proportion of the rent received.

In the example below, which is considered to be a reasonable estimate of the current market, the income from the property drops by 35%.

If there was a tenant free period reducing the rental to £17,500 for the year, the property would only break even on a cash flow basis. All of the previous profit of £3,500 would be paid in tax as in the following example. Please feel free to contact GLM Ghest Lloyd should you have any questions about this topic or anything else that you are worried about currently or in the future regarding your investment.

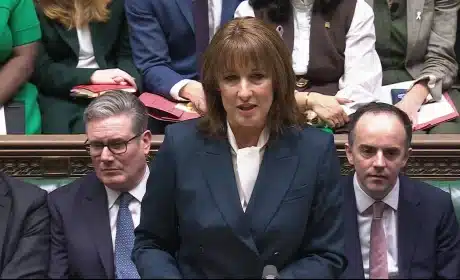

Budget Summary at a Glance

26th November 2025

A chaotic start with early publication from the OBR, but here’s what actually matters from today’s fiscal plan: Budget Summary…

Budget Chaos and What It Means for Brighton & Hove Landlords

26th November 2025

Well that was interesting! Today’s Budget took an unexpected twist when the details were released in full and online by…

Renter’s Rights Bill receives Royal Assent: What landlords need to know

28th October 2025

RRB has since received Royal Assent after this article was published. Just over a year since it was first brought…