London and the South East’s falling rental figures are impacting the UK’s rental growth

25th April 2017

London and the South East’s falling rents are impacting the UK’s rental growth according to a UK Estate Agency.

The average rent in the Capital has fallen by 4.7pc whilst the South East has seen a 2.6pc fall. For the month of February, the rent across the country was £921, which was 0.6pc lower than last year.

The fall in rent across the country has been attributed to the 9pc boost in the number of properties on the market across the country, whilst London saw and incredible 18pc more houses compared to last year. The agent has warned however that this would not last and whilst London and the South East had more properties, there were fewer tenants looking for homes. Other regions in the UK saw a rise in rent, but at a slower pace than previous months.

Research Director, Johnny Morris said “recent falls in London and the South East are small in the context of growth in recent years. Rents are a third higher in London and the South East than in 2007. Affordability in London and the South East remains stretched. That is likely to limit rental growth”.

This all comes as an online petition calling for the government to make paying rent become an acceptable means of proof of affordability when applying for a mortgage. If this passes the 100,000 signature threshold it would mean the government can debate the matter in Parliament, although the government has not yet responded.

It is estimated that by 2025, there will be 7.2m households in the UK that are privately rented. This is 1.8m up from the 5.4m houses rented in 2015 and despite the current falls in rents, the Royal Institution of Charted Surveyors predict the rents to rise by more than 20pc in the next 5 years. This will in effect push homeless people and those on benefits out of the private rented sector.

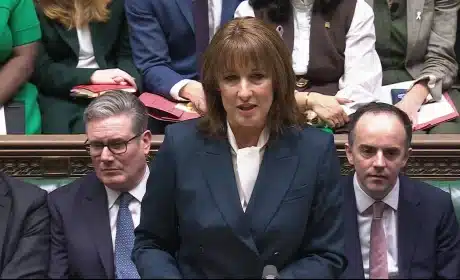

Budget Summary at a Glance

26th November 2025

A chaotic start with early publication from the OBR, but here’s what actually matters from today’s fiscal plan: Budget Summary…

Budget Chaos and What It Means for Brighton & Hove Landlords

26th November 2025

Well that was interesting! Today’s Budget took an unexpected twist when the details were released in full and online by…

Renter’s Rights Bill receives Royal Assent: What landlords need to know

28th October 2025

RRB has since received Royal Assent after this article was published. Just over a year since it was first brought…