Rent payments and credit scores

14th November 2017

On Monday, MPs debated whether rent payments should contribute to credit scores. At present, credit rating agencies do not routinely include rent payment history when calculating credit scores. This means a tenant can find it difficult to access a mortgage, even if they have a long history of rent being paid in full and on time. This followed on from a successful online petition where over 145,000 signed saying “paying rent on time should be recognised as evidence that mortgage payments can be met”.

The survey was started by a renter who had paid over £70,000 of rent, on time and was still struggling to obtain a mortgage. Supporters claim that including rent on an official credit rating will give lenders a more in-depth insight on prospective applicants, giving reliable renters a stronger case when lending. Although, renters with a more inconsistent background may currently be able to benefit from the lack of transparency, as late or missed payments are only likely to lower your score if a CCJ is made against you.

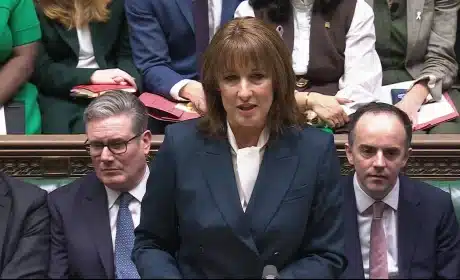

Having already received backing from the Residential Landlords Association with the majority of landlords surveyed agreeing with the proposed motion. Shadow Economic Secretary to the Treasury, Jonathon Reynolds also backed the principle of taking account of rental payments. This decision is set to not only benefit renters but landlords as well, giving them a clearer picture of a prospective tenant’s rental history.

Budget Summary at a Glance

26th November 2025

A chaotic start with early publication from the OBR, but here’s what actually matters from today’s fiscal plan: Budget Summary…

Budget Chaos and What It Means for Brighton & Hove Landlords

26th November 2025

Well that was interesting! Today’s Budget took an unexpected twist when the details were released in full and online by…

Renter’s Rights Bill receives Royal Assent: What landlords need to know

28th October 2025

RRB has since received Royal Assent after this article was published. Just over a year since it was first brought…