Market outlook

9th October 2023

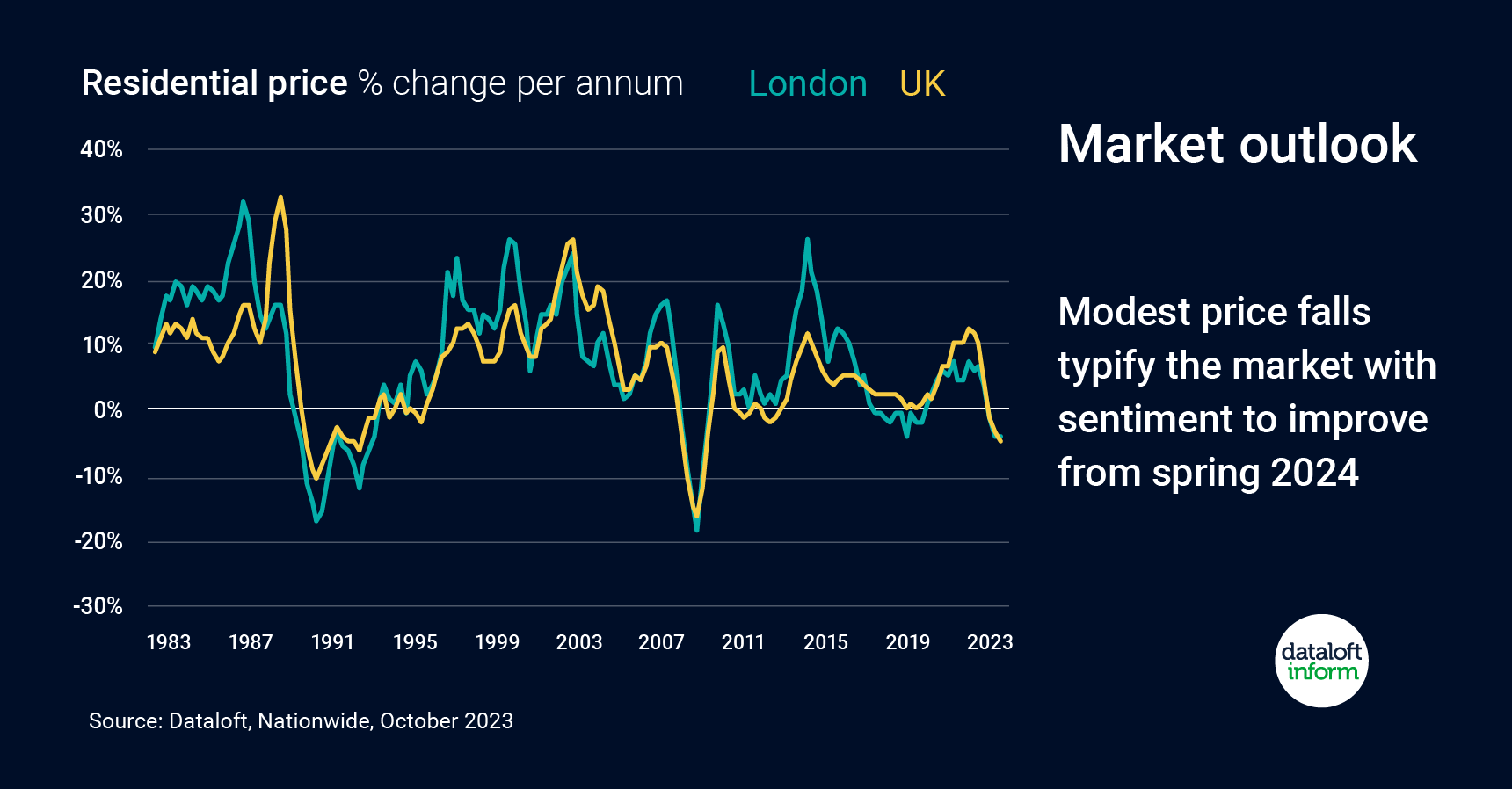

Interest rates are deemed to be at, or close to their peak so any improvement should start to lift sentiment. For the rest of 2023, expect continued low sale volumes and some price volatility but spring 2024 could mark an upturn.

Whilst one more 25bp rise in the Bank Rate is expected however, anything beyond that would be a risk to the fragile shoots of improved sentiment. So too any reversal in the downward trend in inflation.

The shock of rapid changes to interest rates in Q3 2022 triggered sharp quarterly price falls over the winter, in Q4 2022 and Q1 2023 but since then the market has stabilised and prices are actually higher today than they were at end Q1 2023.

Source: #Dataloft, Nationwide

Confidence Creeping Back? What the Latest Sales Market Data Is Telling Us

23rd April 2025

After a period of economic uncertainty and slower transaction volumes, early 2025 is starting to show renewed energy across the…

Staying Ahead of the Curve: 5 Smart Ways Brighton Landlords Can Stay Compliant with EPC Changes

9th April 2025

Energy efficiency has become a central focus for UK landlords. And in Brighton with our mix of Victorian terraces, seaside…

New Sanctions Checks from May 14: What Landlords Need to Know

9th April 2025

From 14 May 2025, a new set of government regulations is coming into force around sanctions checks – and while…