Maximising first-time buyer purchasing power

1st March 2024

- Stamp Duty Land Tax has hit the headlines again recently with Rightmove urging the Chancellor of the Exchequer to reform Stamp Duty in the Spring Budget. There is a Stamp Duty threshold of £250,000 in England (£425,000 for first-time buyers) and £225,000 in Wales (Land Transaction Tax).

- Regional price variations mean that first-time buyers may have to factor Stamp Duty into their often tight budget. First-time buyers can maximise purchasing power by reducing Stamp Duty liability and this could mean widening the search areas for their first home.

- Analysis by Dataloft reveals that throughout 2023, 75% of homes across England and Wales were sold at prices below the Stamp Duty threshold for first-time buyers. However, there was a large regional variation and this figure was as low as 35% (Greater London) in some areas and as high as 98% (County Durham) for others.

- Our map shows that a distinct north-south divide remains across the country and with hybrid working becoming a more permanent style, there is still a great opportunity for first-time buyers in the south to consider relocating further north. Source: #Dataloft, Land Registry 2023

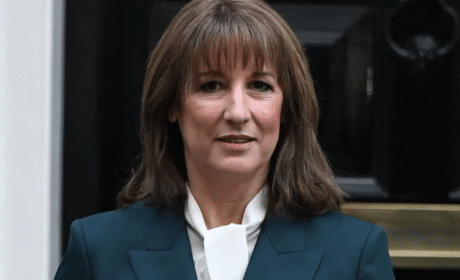

Budget Summary at a Glance

26th November 2025

A chaotic start with early publication from the OBR, but here’s what actually matters from today’s fiscal plan: Budget Summary…

Budget Chaos and What It Means for Brighton & Hove Landlords

26th November 2025

Well that was interesting! Today’s Budget took an unexpected twist when the details were released in full and online by…

Renter’s Rights Bill receives Royal Assent: What landlords need to know

28th October 2025

RRB has since received Royal Assent after this article was published. Just over a year since it was first brought…