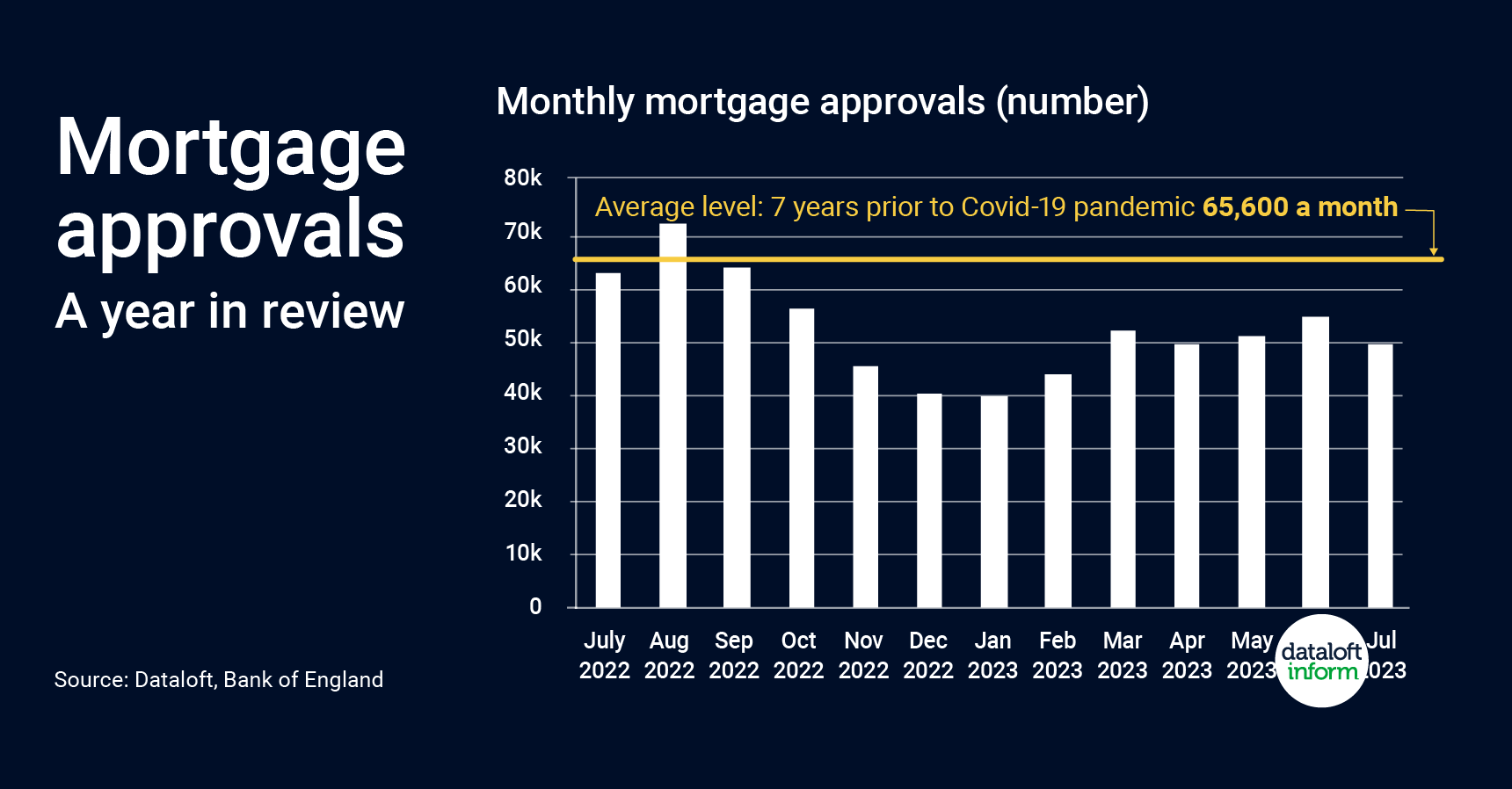

Mortgage approvals: a year in review

4th September 2023

Mortgage approvals lead trends in residential sales activity by around 3 months. As such, mortgage approvals will be a key leading indicator to monitor for more signs of market activity over coming months.

The number of approvals has risen since the beginning of 2023 but remains below usual levels. In the year to end July, approvals averaged 51,600 a month. This is 21% below levels recorded in the 7 years prior to the Covid pandemic.

Whilst inflationary pressures certainly persist, recent inflation data has been encouraging. Interest rates are forecast to peak this year and start falling in 2024. Any pick-up in market activity will show first in mortgage approvals.

Mortgage approvals were at their lowest in December 2022 and January 2023. In part a seasonal impact but largely a reaction to inflation and interest rate uncertainty.

Source #Dataloft, Bank of England

Budget Summary at a Glance

26th November 2025

A chaotic start with early publication from the OBR, but here’s what actually matters from today’s fiscal plan: Budget Summary…

Budget Chaos and What It Means for Brighton & Hove Landlords

26th November 2025

Well that was interesting! Today’s Budget took an unexpected twist when the details were released in full and online by…

Renter’s Rights Bill receives Royal Assent: What landlords need to know

28th October 2025

RRB has since received Royal Assent after this article was published. Just over a year since it was first brought…