Rents: Higher or Lower?

17th August 2021

You may be surprised to learn the proportion of gross income private renters in England and Wales spend on their rent is only marginally higher than five years ago. The percentage of income spent on rent is currently an average of 28.3%.

Over the past five years, average earnings of renters have risen by 8.8% while average rents have risen by 9.6%.

In the North East and South West, renters spend proportionally less than they did back in 2015/16. The North West is the only region where the proportional increase in spend is more than 1%.

Currently demand for rental properties is high. Average asking rents in Q2 2021 were up 2.6% year-on-year (Rightmove) and a shortage of stock looks set to underpin prices over the coming months.

The average monthly rent in the UK in now at a record high of £1,029. In the twelve months to July 2021, UK monthly rent increased by 6.6%, rising from £965 to £1,029.

In July, all regions in the UK experienced an annual increase in monthly rent, with the South West experiencing the biggest increase, 12.9%.

Over one in five of all new rental tenancies are agreed in August and September, so the next two months are set to be busy.

Rental forecasts look strong, with the RICS residential survey forecasting rents to rise +3% over the next twelve months. Source: Dataloft, HomeLet. Dataloft Rental Market Analytics (DRMA), based on tenancies started 01.07.20 to 30.06.21 and 01.07.15 to 30.06.16

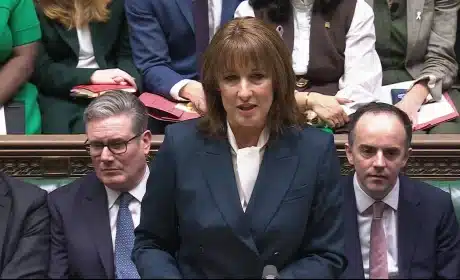

Budget Summary at a Glance

26th November 2025

A chaotic start with early publication from the OBR, but here’s what actually matters from today’s fiscal plan: Budget Summary…

Budget Chaos and What It Means for Brighton & Hove Landlords

26th November 2025

Well that was interesting! Today’s Budget took an unexpected twist when the details were released in full and online by…

Renter’s Rights Bill receives Royal Assent: What landlords need to know

28th October 2025

RRB has since received Royal Assent after this article was published. Just over a year since it was first brought…