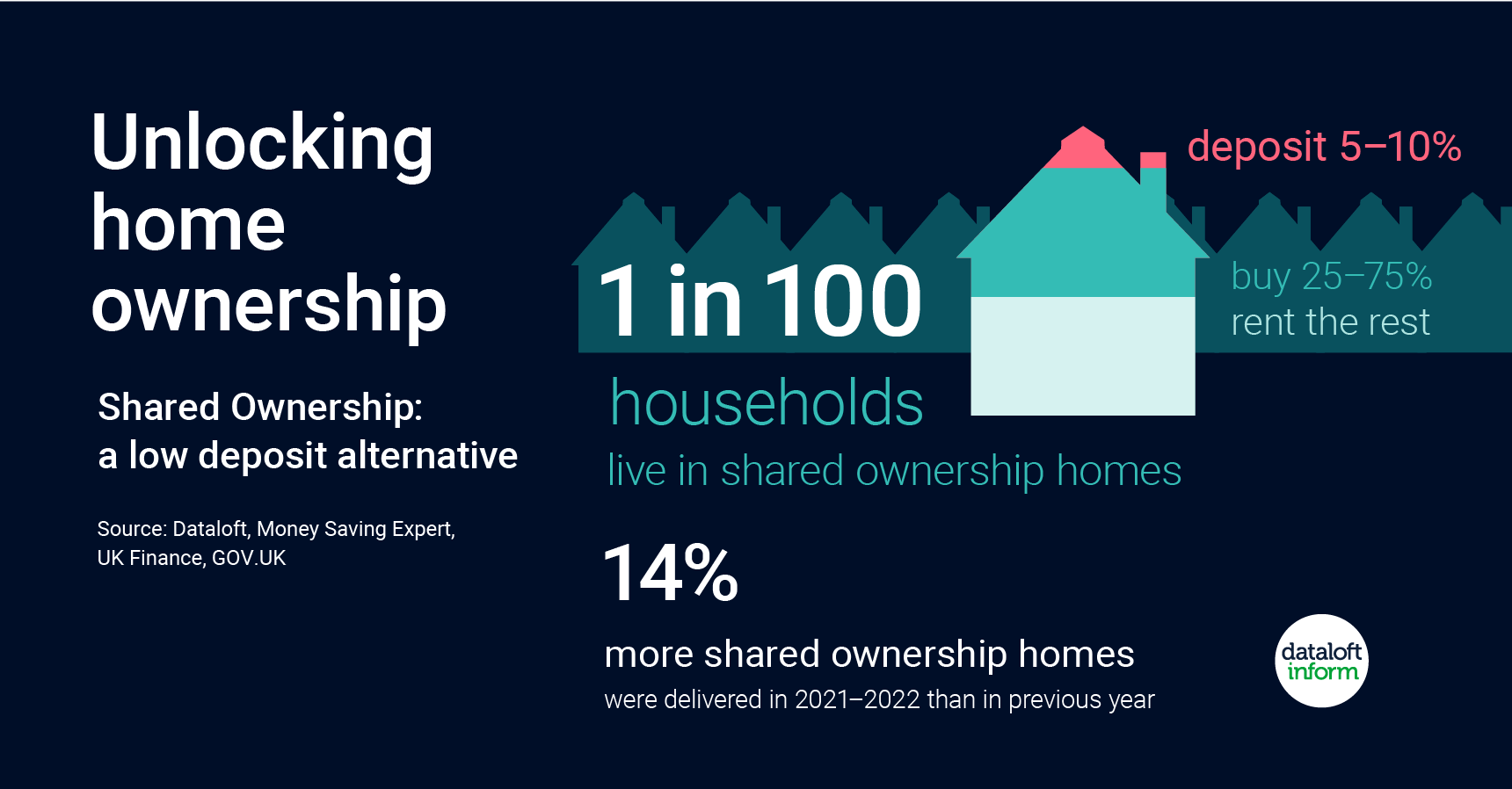

Unlocking home ownership

21st August 2023

With the close of the Help to Buy scheme, there is a clear gap for those looking for a low deposit solution to buying a home. Around 1 in every 100 households in the country live in shared ownership homes.

Shared ownership gives buyers the option to buy a share (between 25% and 75%) of their home, and pay rent on the remaining share. Over time more shares can be bought and the home can eventually be owned outright.

The required deposit (usually between 5% and 10% of the share bought) is significantly less than the average deposit of 24% paid by UK first-time buyers, making it an affordable option for home ownership.

Not exclusive to first-time buyers, those with a household income of £80,000 a year or less (£90,000 or less in London) and that cannot afford a home that meets their needs can qualify. Source: #Dataloft, Money Saving Expert, UK Finance, GOV.UK

Budget Summary at a Glance

26th November 2025

A chaotic start with early publication from the OBR, but here’s what actually matters from today’s fiscal plan: Budget Summary…

Budget Chaos and What It Means for Brighton & Hove Landlords

26th November 2025

Well that was interesting! Today’s Budget took an unexpected twist when the details were released in full and online by…

Renter’s Rights Bill receives Royal Assent: What landlords need to know

28th October 2025

RRB has since received Royal Assent after this article was published. Just over a year since it was first brought…