Yields remain lucrative in the current rental market

10th August 2022

Based on an analysis of apartments sold and rented over the past 12 months, the indicative gross yield is 5.8%, up from 5.1% 3 years before. The gross yields have risen across all regions of England & Wales, compared to 3 years ago.

From a survey of over 1,000 landlords by Dataloft with Homelet, 73% of landlords were planning for their portfolios to stay the same size over the next year, with 1 in 10 looking to expand.

Nearly 50% see their portfolio as their long-term pension, 25% more consider property the best place to invest and 17% hope to increase their monthly income.

At the time of writing, the Bank of England base rate is 1.25%, with the average interest rate on a 1-year fixed rate ISA in the region of 2.5%. Rightmove predict that rentail values will rise by 8% over the course of 2022, and rental growth is set to overtake sales growth.

(Source: Dataloft, DRMA, Land Registy, DLUHC, Homelet, Rightmove, Bank of England, Moneyfacts)

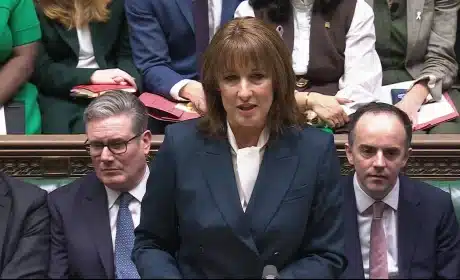

Budget Summary at a Glance

26th November 2025

A chaotic start with early publication from the OBR, but here’s what actually matters from today’s fiscal plan: Budget Summary…

Budget Chaos and What It Means for Brighton & Hove Landlords

26th November 2025

Well that was interesting! Today’s Budget took an unexpected twist when the details were released in full and online by…

Renter’s Rights Bill receives Royal Assent: What landlords need to know

28th October 2025

RRB has since received Royal Assent after this article was published. Just over a year since it was first brought…